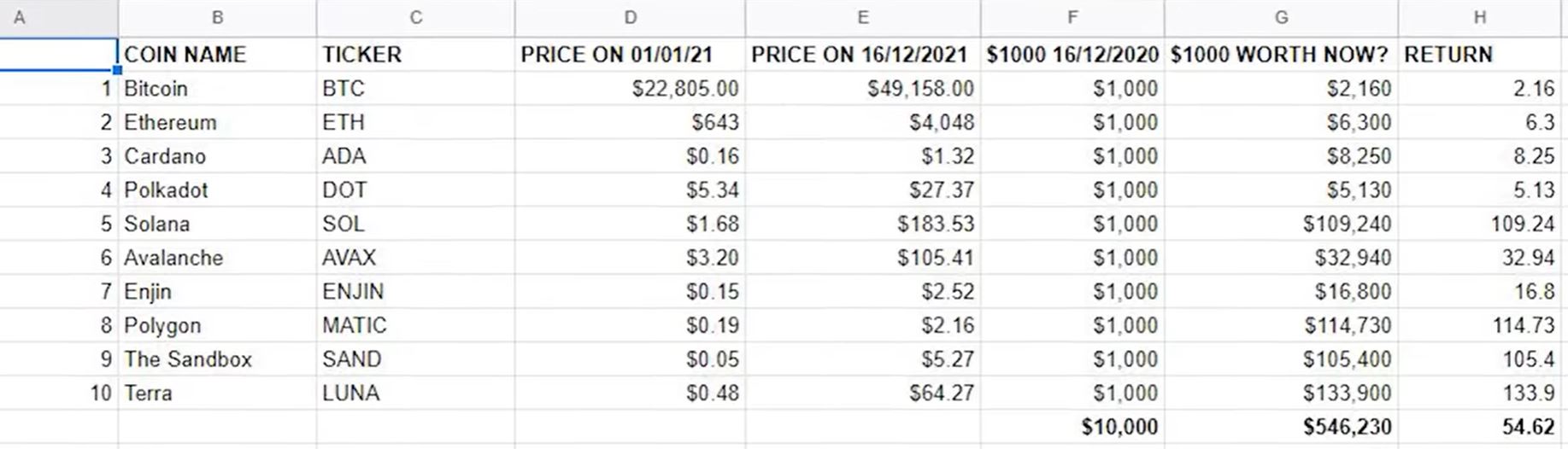

Top 10 Cryptocurrency To Invest In 2022

The cryptocurrency market has been increased substantially over the past year if you invested $1K of the 10 cryptos in this article you would have $546K today. Since the cryptocurrency market has a really good sentiment in 2021, we think that it'll be good as well for 2022. December 2021 Bitcoin pricing is running in the sideway but yet had its parabolic rally and if the history repeats itself that means the best gains are still to come. This article shares the best most popular cryptocurrencies that we think will do very well next year.

BITCOIN (BTC)

If you invested $1K one year ago, you will have $2.16K which is a 2.16 return ratio. What gives bitcoin its value is that it can be electronically traded peer to peer without centralized third parties. It's also a long-term store value and sometimes called digital gold. Bitcoin works as a decentralized ledger that records transactions between different parties, unlike banks. There is no one centralized authority in charge of keeping it accurate instead the combined power of millions of individual ledgers acts as the safeguard. Bitcoin has a record high of $69K and retraced back to $49K.

Notable events of Bitcoin in the past year include Elon Mask's announcement that Telsa would purchase bitcoin and accept it for payments before later stopping that. El Salvador became the first country in the world to make Bitcoin legal tender. The Chinese government ban on financial institutions and minors mining or owning bitcoin and the introduction of the first Bitcoin futures ETF. The biggest upcoming catalyst for Bitcoin in 2022 could potentially be the SEC allowing Bitcoin spot ETF to be traded in the US as well as potential adoption of Bitcoin as legal tender in more countries such as Paraguay and Panama.

Threads to Bitcoin in 2022 include the potential for more tapering from the US Federal Reserve to curb inflation while helping bitcoin in the long run, this will hurt it in the short term. There is also potential for China or other countries to introduce further restrictions as well as the potential for a sharp decline in dominance as investors move funds to altcoins to chase more gains later on in a cycle.

Despite the potential for further crashes like May 2021 if the market overheats again we think Bitcoin will go on making further gains further in 2022 and can reach a new record high of $120K.

ETHEREUM (ETH)

If you invested $1K in Ethereum a year ago, you will gain $6.3K in the 6.3 return ratio. Ethereum is valuable because it allows a wide range of complex financial and non-financial transactions to take places such as lending and borrowing. It does this through the use of the smart contract which automatically carries out predetermined actions once preset conditions have been met. The all-time high of Ethereum was $4.8K.

The most significant events of ETH in 2021 have been its Berlin and London hard forks which stabilize fees and improve network performance and also will potentially allow it to be deflationary eventually as well as explosive growth in users due to increasing popularity around Defi and NFT. Despite achieving a lot this year, Ethereum delayed some upgrades for ETH 2.0 as well as the increase in difficulty. Continuing delays could risk Ethereum being outpaced by faster chapter rivals. $10K to $12K are realistic price targets that Ethereum can reach in 2022.

CARDANO (ADA)

If you invest $1K in Cardano a year ago, you will have $8.2K today. Cardano aims to be the faster chapter and decentralized than Ethereum and Bitcoin. It uses peer-reviewed research to build its protocol. Cardano's main difference to Ethereum currently is that its proof-of-stake meaning it uses a different method to verify transactions which makes them chapter and faster. Proof of stake allows anyone to verify transactions in relation to how many coins they hold rather than using GPUs to solve mathematic problems (Proof of Work).

The biggest event of Cardano in the past year was the introduction of its Alonzo upgrade which allows basic smart contracts to be created on the network. The adoption of the Cardano blockchain in some African countries such as Ethiopia and the launch of ADA on most trading platforms such as Coinbase. Cardano is expected to be able to support more complex smart contracts next year compared to other blockchains which will allow much more Defi protocols to be able to operate on the network. Further deals with countries in Africa and South America are also anticipated. Similar to Ethereum Cardano's biggest trend is its delays of important features such as the ERC20 token converter which was originally scheduled to be released in September. More delays could lead to investors switching to alternatives if confidence starts to fade that they will actually meet their deadline. ADA has been oversold in the past few months so if these upgrades arrive, the price of ADA would surge to around $5 to $7 as liquidity dries up and FOMO restart.

Polkadot (DOT)

If you invested $1K in Polkadot one year ago, you will have $5.13K today. Polkadot is a layer one smart contract platform like Cardano or Ethereum which seeks to be the internet of blockchain. It is comprised of two main parts included an individual chain known as para chains which host projects and are all connected to its main chain known as relay chain. The most significant event for Polkadot started recently which was the launch of its PARACHAINS AUCTIONS. This allows competing projects to bid for a place in a para chain. Winning projects will keep their slot for up to 96 weeks. 2022 will be a much better year for Polkadot that has the Parachains auction is underway which is one of the best technology currently in crypto that will attract more investment.

SOLANA (SOL)

If you invested $1K in Solana one year ago, you will have $109K today. Solana is the fastest blockchain in crypto at the moment and its transactions cost less than one cent. This is caused by the rapid growth of projects in its network in 2021 with over 400 on its layer one protocol. Solana has achieved immense speed using its proof of history consensus mechanism instead of proof of work or proof of stake used by competitors. Proof of history timestamps transactions and uses less energy making it the cheapest and fastest solution currently available. The pricing of Solana soaring over 100x and retrace down where it's started. Solana is one of the altcoins that have experienced major run-ups in 2021 heavily based on its fundamentals and looks likely to continue that trend in 2022.

The biggest thread to Solana moving forward is undoubtedly that is viewed by many as the most centralized layer one due to its heavy reliance on the Solona foundation. Solana can reach a high of one thousand dollars ($1K) in 2022 at the peak of the bull run as it moves out of its current accumulation period.

AVALANCHE (AVAX)

If you invest $1K at the beginning of 2021, you will have $32.9K today. Avalanche has exploded in popularity over the last few months as people look to faster and chapter alternatives to Ethereum's rising gas fee that keep most retail investors out of the market. Avalanche achieves this because it's a proof of stake blockchain compatible with the Ethereum virtual machine which the software devs use to program Dapps on Ethereum. Avalanche can process 4500 transactions per second compared to just 15 for Ethereum. Avalanche is one of the layer ones that has experienced substantial gains over the past couple of months despite overall market weakness and is still showing strong price strength recently. Rumors that Gray Scale may make a major investment into Avalanche in 2022 as institutional interest in the platform continues to grow and if this happens you can be sure that AVAX's price will benefit as many greyscale investments have in the past after big announcements.

The biggest thread for Avalanche in 2022 is what will happen after ETH 2.0 upgrades have been introduced. Will this remove the need for solutions like Avalanche that's a main selling point is that it's faster and cheaper than Ethereum or will the avalanche network be sufficiently mature and have its own value proposition. The price of AVAX can reach $350 to $400 at its high in 2022.

Terra (LUNA)

If you invest $1K at the beginning of 2021, you will have $133K today which is the highest return on the list. Terra is a collection of stable coins which is pegged to the dollar. What makes Terra special is the fact that its stable coins are decentralized and backed by the luna token rather than dollars or treasury bills like centralized stable coins such as USDT or USDC. The Terra ecosystem is powered by the luna token which is used for staking governance and collateral of stable coins when more stable coins are printed luna is burned which decreases the supply. This would be like the US government burning gold or something of perceived value every time dollars are printed.

The biggest catalyst for Luna of the past year is the factory in a bull run this has led to demand for stable coins for uses exit liquidity and also to park gains combined with an increase in skepticism over centralized stable coins such as Tether this has led to surge in demand for luna. The largest thread to luna is a major decrease in demand for stable coins likely to happen at the very tail end of the bull run. This combined with a loss of demand for crypto in general could cause luna to fall faster than other altcoins. Luna can reach $400 to $500 at its peak in 2022.

ENJIN (ENJ)

If you invest $1K at the beginning of 2021, you will have $16K today. Enjin is one of the faces of crypto gaming in the metaverse and aims to make it as easy as possible for companies individuals and brands to mint and manage their own NFT and games and other use cases they may have as well. ENJIN is an Ethereum project that uses its own native token to back the value of NFTs generated in its ecosystem. The Enjin software kit is one of the most advanced and allows game devs to easily include NFTs in their games. Enjin is like Windows for crypto gaming, sure you could go alone and figure out everything yourself and write your own software but most companies will rather save a lot of time and money and use Enjin SDK instead.

The biggest event for Enjin in 2021 was the crypto gaming bull run in Q4 triggered by facebook's pivot to the metaverse and renaming their company to META. This caused a wave of attention to flow into the space causing thousands of investors to jump into Enjin. Enjin also secured many valuable partnerships and released new updates as well. Enjin and crypto gaming are going to finally start to go even more mainstream next year and that is going to lead to an increase in demand for it even if the market is somewhat bearish.

In the future not have so many threads because crypto gaming in the metaverse is here to stay and it's only going to grow stronger and Enjin is the leader in its field making it one of the safest bets in crypto.

SANDBOX (SAND)

If you invest $1K at the beginning of 2021, you will have $105K today. Sandbox is a 3D open-world metaverse where players can create the world using NFTs. The land inside the metaverse is bought and sold on NFT marketplaces such as OpenC. Players can design their own avatars to access different games and environments in the sandbox metaverse. The sandbox is like a limited Minecraft server where people can own the land inside the game and trade it, flip it, build projects on it or rent it out to companies for advertising. Sandbox pricing has soared up 10x to $8 on its peak in mid-November. The announcement by Mark Zuckerberg that Facebook would be shifting its focus to the metaverse is undoubtedly the main reason that sandbox skyrocketed. One of the biggest to Sandbox is that regulators will judge that it's a security and not a currency. This is the danger for most altcoins until they get cleared by the SEC.

The crypto gaming market overheated recently and may have some more consolidation in the short term as early investors take profits. Overall, crypto gaming and the metaverse appear to be going mainstream already. The sandbox may reach $25 to $30 in 2022

Polygon (MATIC)

If you invest $1K at the beginning of 2021, you will have $114K today. Polygon is arguably the most used scaling solution for Ethereum and its own trading volume even exceeded ETH back in June as investors looked for low-cost solutions to each monumental gas fee. Polygon is a layer two scaling solution for Ethereum this means that transactions are handled off the main layer one chain of Ethereum. This is like building more roads to stop the traffic building up on the main road. It has drawbacks but if you don't mind going a little out of your way then it can save you a lot of time money and frustration.

Polygon has performed exceptionally during periods of time where ETH has been very strong in 2021 both in May and now in Q4. When ETH has gone on solid runs, Polygon has outperformed it however polygon has also dipped a lot more during market downturns so it's essentially like a more leveraged position of Ethereum. Polygon can reach $8 to $12 in 2022.

REFERENCE: https://www.youtube.com/watch?v=N68tPlvRoII